Ever felt like you’re missing the party while everyone else is making bank on Solana? Trust me, I’ve been there – staring at my screen wondering how the heck some random dude turned $100 into a lamborghini with a memecoin I’ve never heard of.

The secret? It’s not magic, it’s Solscan – your personal blockchain detective agency that lets you see what the smart money is doing before everyone else catches on.

To do so, we’re going to cover 5 key points:

- 🤔 What is Solscan?

- 📖 How to Read and Understand a Transaction?

- 🕵️ Tokens Investigation Using Solscan

- 💼 Wallet Analysis

- 🔗 Track Down Related Wallets

By the time we’re done here, you’ll not only understand how Solscan can help you explore wallets, analyze tokens, inspect transactions, and track wallets but also uncover pro-level strategies that others rarely talk about!

What is Solscan and Why is it Special? 🤔

Let’s be real – most people trade crypto like they’re blindfolded at a dart competition. They ape into whatever CryptoMoonBoy69 shills on Twitter, then panic sell when it dumps 40%.

But what if you could:

- See exactly what profitable wallets are buying before tokens pump 1000%

- Verify if that “next big memecoin” is actually a honeypot waiting to rug

- Track down entire networks of successful traders and copy their moves

- Understand complex blockchain transactions like you’re reading a children’s book

This isn’t fantasy – it’s exactly what Solscan lets you do. It’s like getting X-ray vision in a market where everyone else is squinting.

Blockchain Transactions: Reading Between the Lines 📝

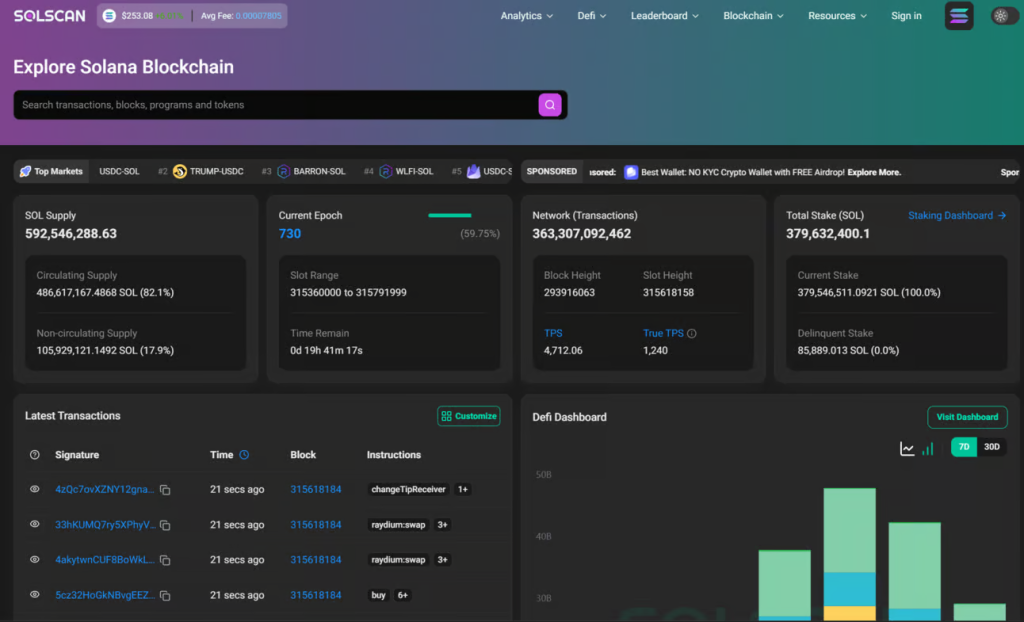

When you paste a transaction hash into Solscan, you’re not just looking at random numbers and addresses – you’re uncovering a story.

Let us break down what you’re actually seeing:

- Signature: That long string starting with “4eeuc” is like a transaction’s fingerprint. It’s unique and permanent.

- Block: The number 315624922 tells us where in Solana’s history this transaction lives. It’s like a page number in the blockchain’s endless book. The higher the number, the more recent the transaction.

- Timestamp: More than just a date and time, the “January 22, 2025 11:06:13 UTC” tells us precisely when this transaction took place. UTC is crucial here, since it’s blockchain’s universal clock, making sure everyone’s on the same time.

- Result: When you see “SUCCESS” with “Finalized”, it means this transaction is set in stone. That green checkmark isn’t just for show, it means everything went exactly as planned, with maximum network confirmation.

- Signer: The address starting with “3kgm” is our transaction’s author. This is the wallet who kicked off the whole process and paid the fees.

- Transaction Actions: Here’s where the real story unfolds. In this case, someone swapped 2 WSOL (Solanas) for “PILL” tokens on Raydium. Each step is laid out clearly, showing you exactly how value moved around.

- Fee: That tiny 0.00023 SOL charge is like the blockchain’s processing fee. It’s what keeps Solana running, and every transaction needs to pay it.

- Priority Fee: Think of this 0.000225 SOL as a “fast pass” payment. When someone pays a higher priority fee, they’re essentially telling the network, “I want this processed quickly.”

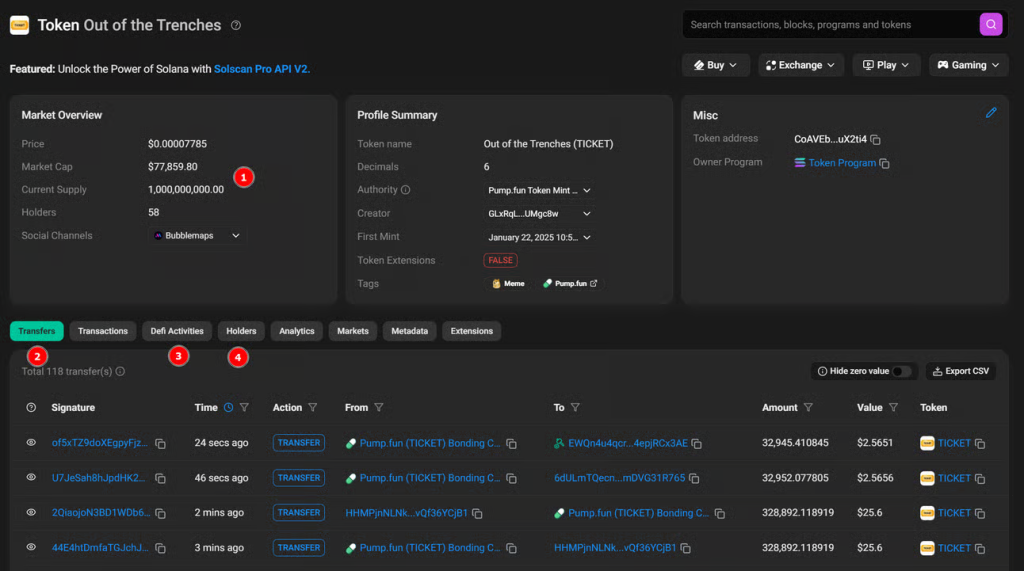

🔎 Token Investigation: Separating Gems from Rugpulls

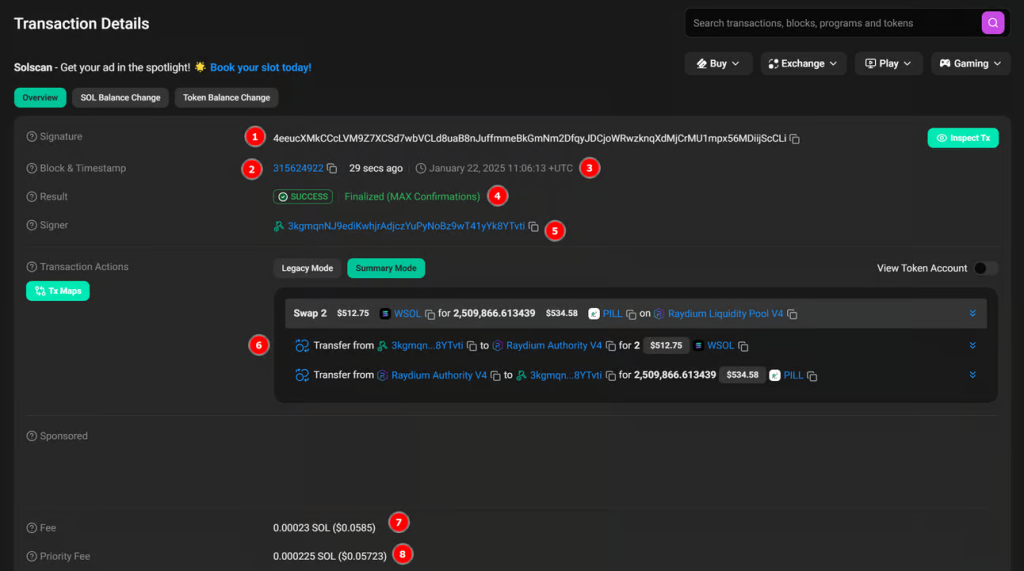

Here’s where Solscan really saves your bacon. Before aping into that token your favorite influencer is shilling, run it through the Solscan background check.

What to look for immediately:

- Basic Stats – Current price, market cap, supply, and holder count. If something smells fishy (like a $500M market cap with only 3 holders), run for the hills.

- Transfers – This is the heartbeat of a token. Is it active with organic trading, or just wash trading between the same few wallets? Solscan shows every move.

- DeFi Activities – Same info as Transfers but with a cleaner interface. Perfect for spotting patterns without going cross-eyed.

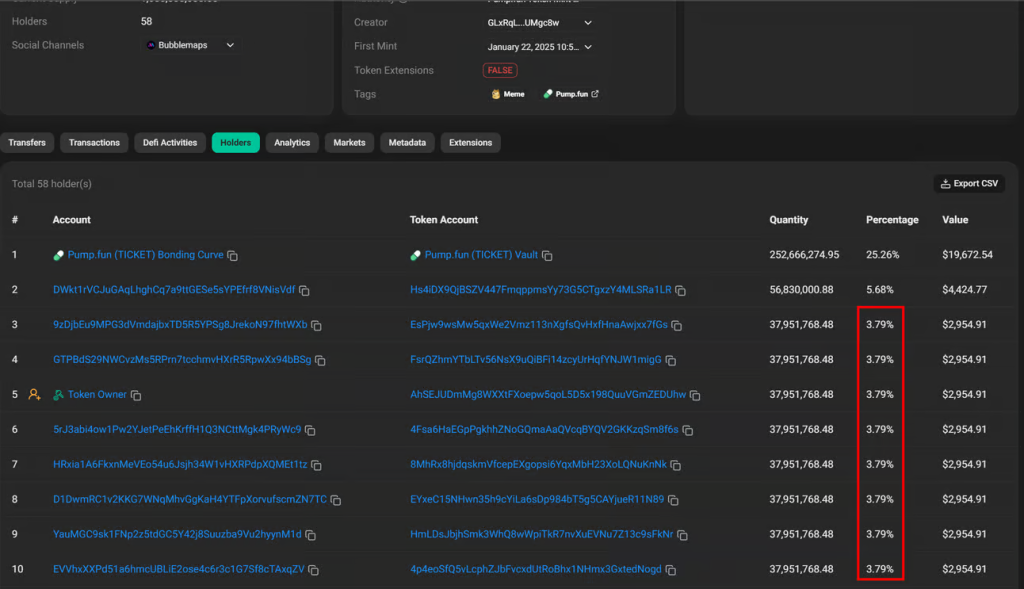

- Holders – This tab is literally worth its weight in SOL. It shows exactly who controls the token’s supply.

Pro tip: The “Holders” tab is your best friend for spotting red flags. See multiple wallets with suspiciously similar percentages? That’s the blockchain equivalent of someone wearing a fake mustache disguise.

Look at that screenshot – several wallets each holding exactly 3.79% of the token supply. This isn’t a coincidence, my friends. It’s a tactic used to mask large holdings and set up for a coordinated dump. If you see this pattern, your “rug pull” alarm should be blaring.

💼 Wallet Analysis: Following the Smart Money

Every wallet on Solana tells a story, and Solscan helps you read the entire thriller, not just the back cover.

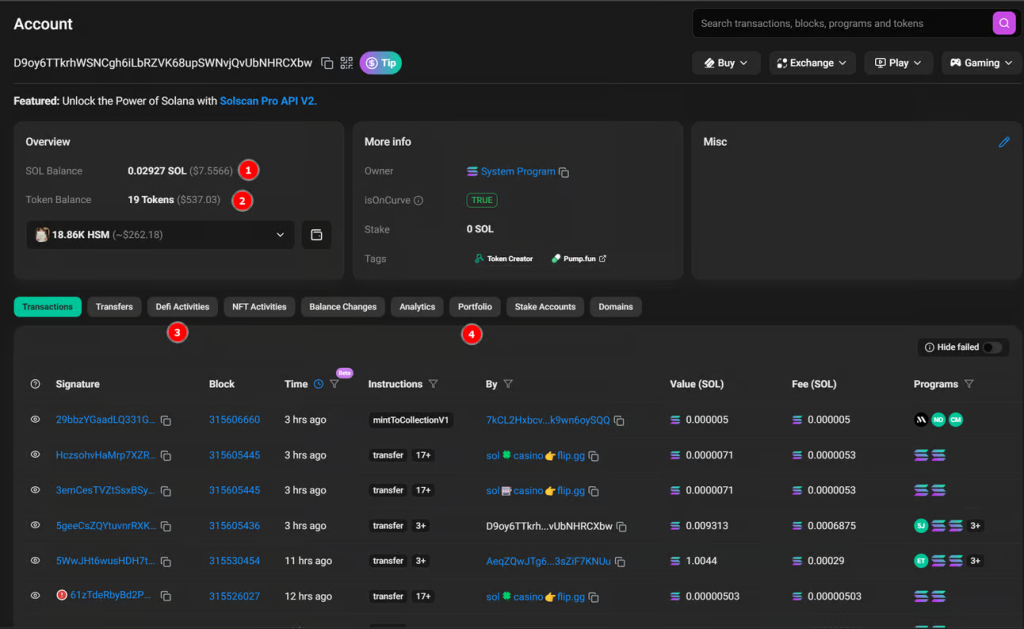

When you look at a wallet in Solscan, pay attention to:

- SOL Balance – How much gas money they’re holding tells you a lot about their activity level and potential future moves.

- Token Holdings – What are they holding, and in what proportions? This is your window into their investment strategy.

DeFi Activities – The goldmine. This tab shows all their memecoin transactions with helpful filters to find exactly what you’re looking for.

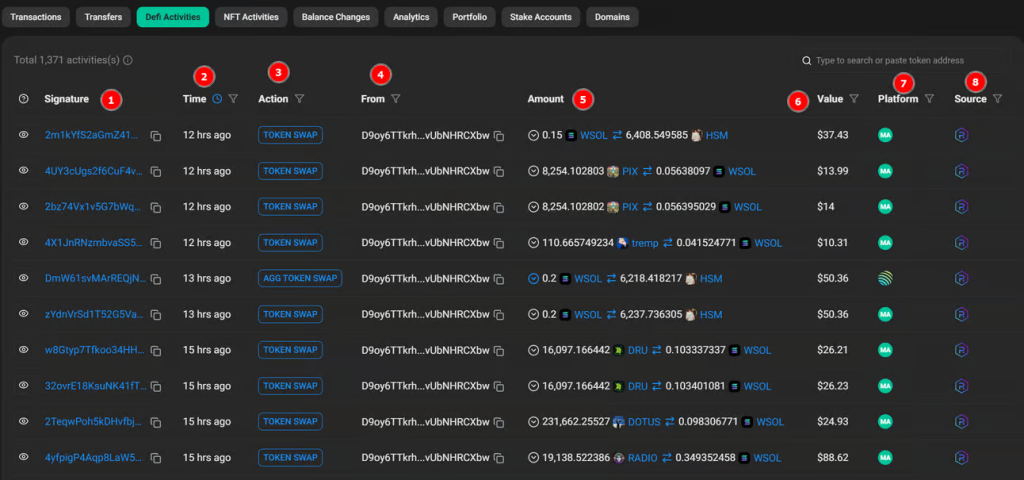

- Signature: The signature of the transaction.

- Time: When was this transaction performed.

- Action: What type of action was this transaction. Most of the times will be “TOKEN SWAP”, which means that there was a buy/sell of a given token.

- From: The wallet who performed this transaction. Note how this address will always be the wallet we are analyzing.

- Amount: The exchanged amounts.

- Value: Value of the transaction in Dollars.

- Platform: The platform it was used to perform the said transaction.

- Source: Which DEX (Decentralized Exchange) was used.

Note that you can apply filters to most of the above mentioned columns, making it easier to find out what you are looking for.

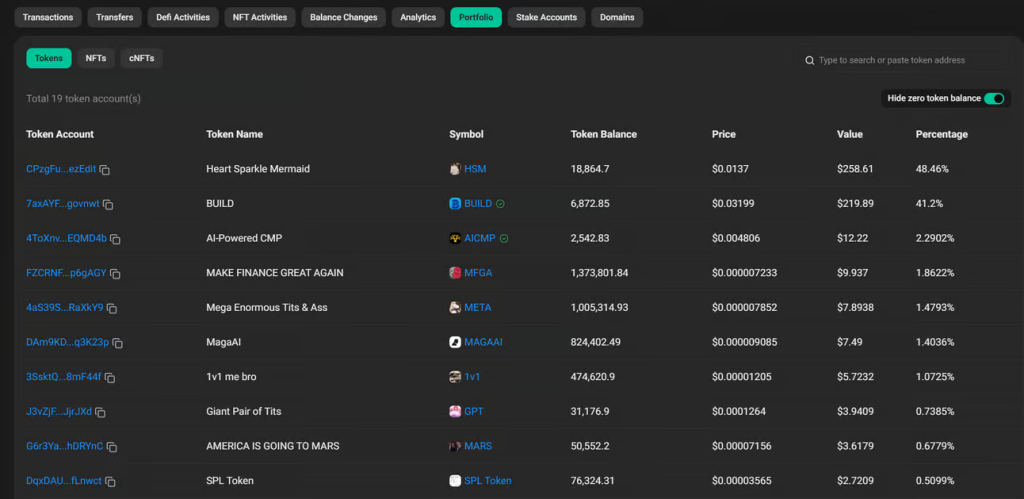

Moving on, we have the “Portfolio” tab, it complements this by giving you an overview of all current token holdings, their quantities, and current market values.

Think of it as a real-time snapshot of what they’re betting on right now. When a wallet that’s made $50k in a week suddenly loads up on a new token, wouldn’t you want to know?

🔗 The Secret Sauce: Tracking Related Wallets

Here’s where amateur detectives stop and pros keep digging. Finding one profitable wallet is just the beginning – the real skill is uncovering entire networks of related wallets.

When you find a successful wallet that’s gone quiet (no SOL balance), that’s when the real investigation begins!

Untrackable Wallets ❌

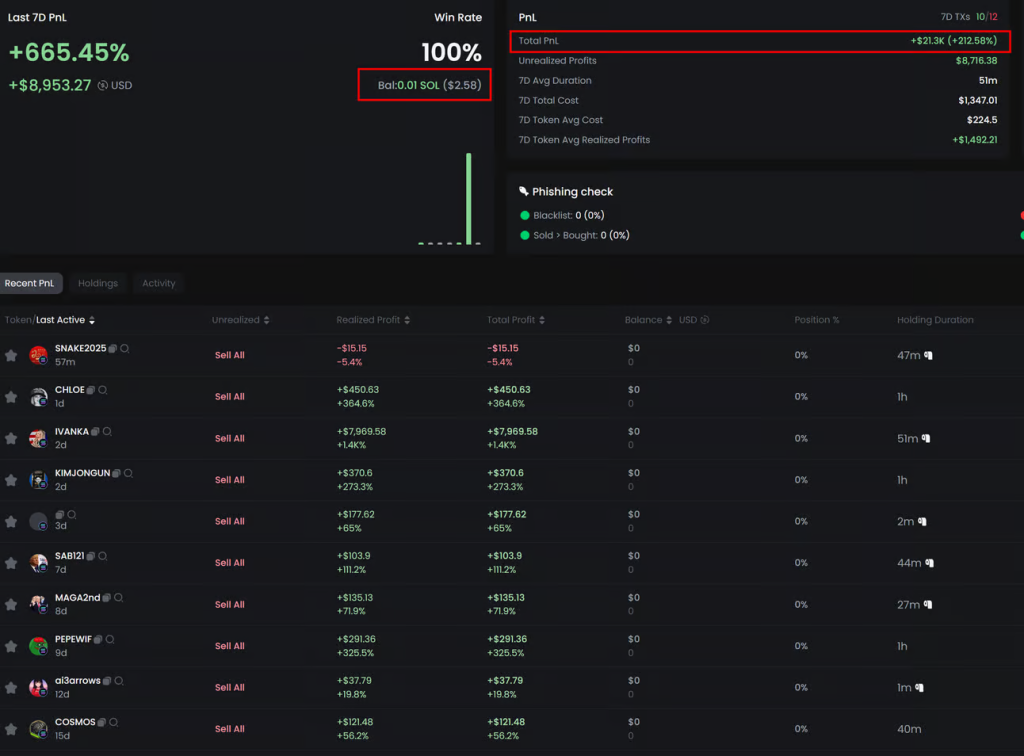

See the wallet above? It made over $21k in a week but has no SOL left. This means the trader has moved their funds elsewhere, making the chances of it trading again basically zero.

In these cases, we need to look at two critical things:

- Which wallet sent the initial funds (the parent wallet)

- Where the profits were sent (the storage wallet)

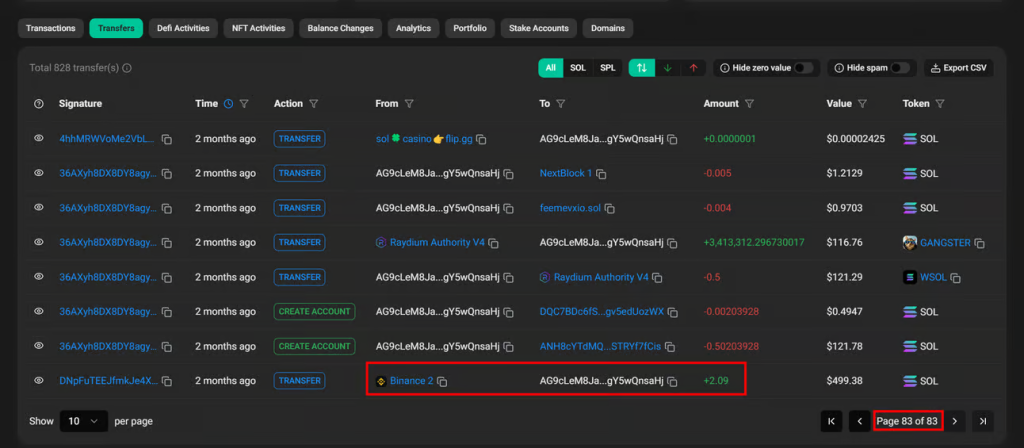

Often, you’ll hit a dead end when wallets are funded by centralized exchanges like Binance:

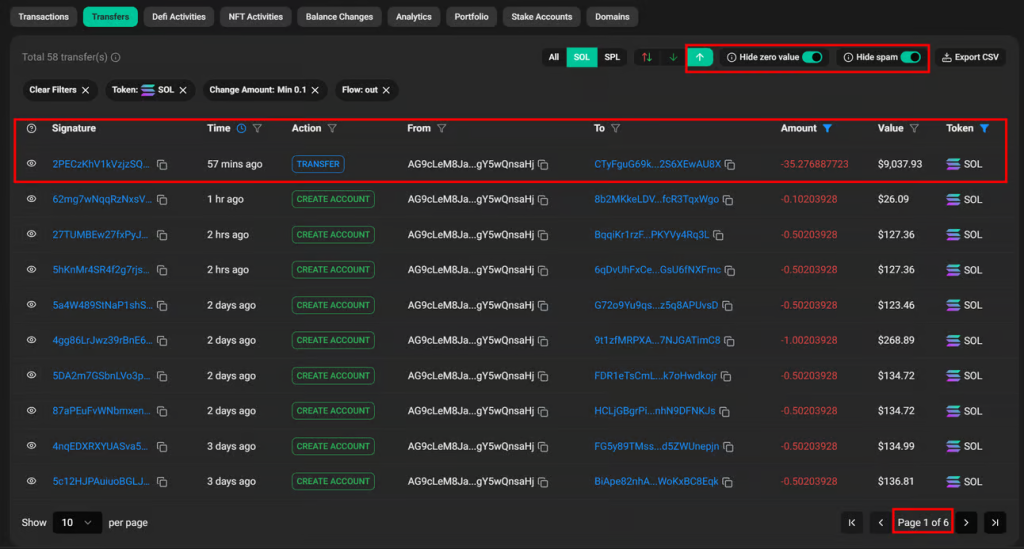

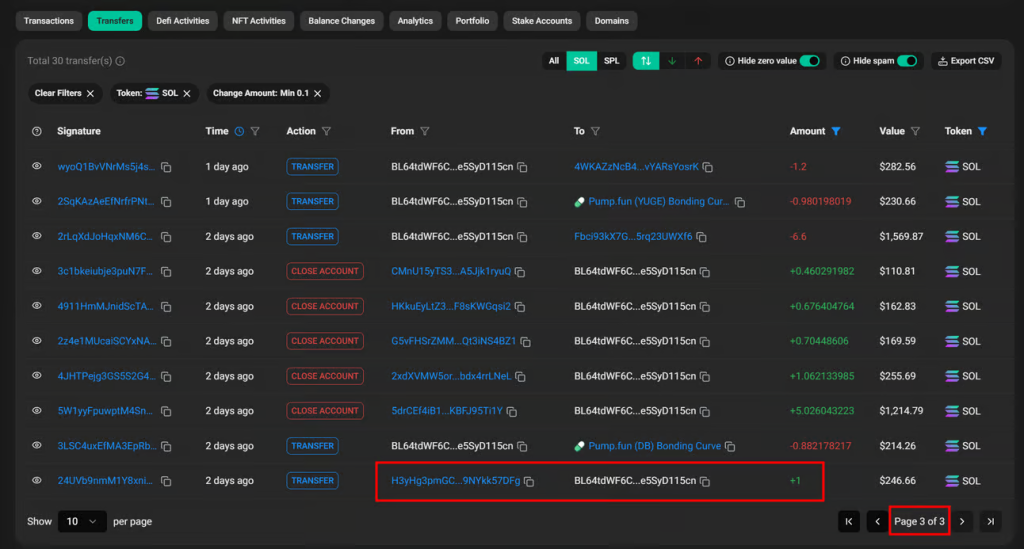

When checking where profits went, we look for large outgoing SOL transactions:

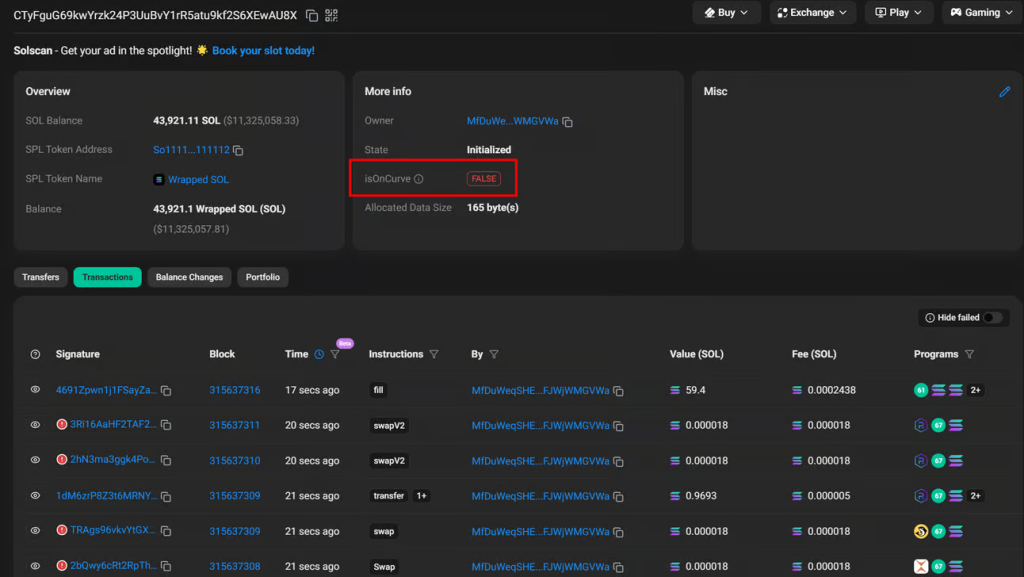

Sometimes the destination is another exchange or an automated system:

If you see a wallet with transactions every few seconds, it’s likely not worth tracking further – it’s probably an automated system or exchange wallet.

Trackable Wallets ✅

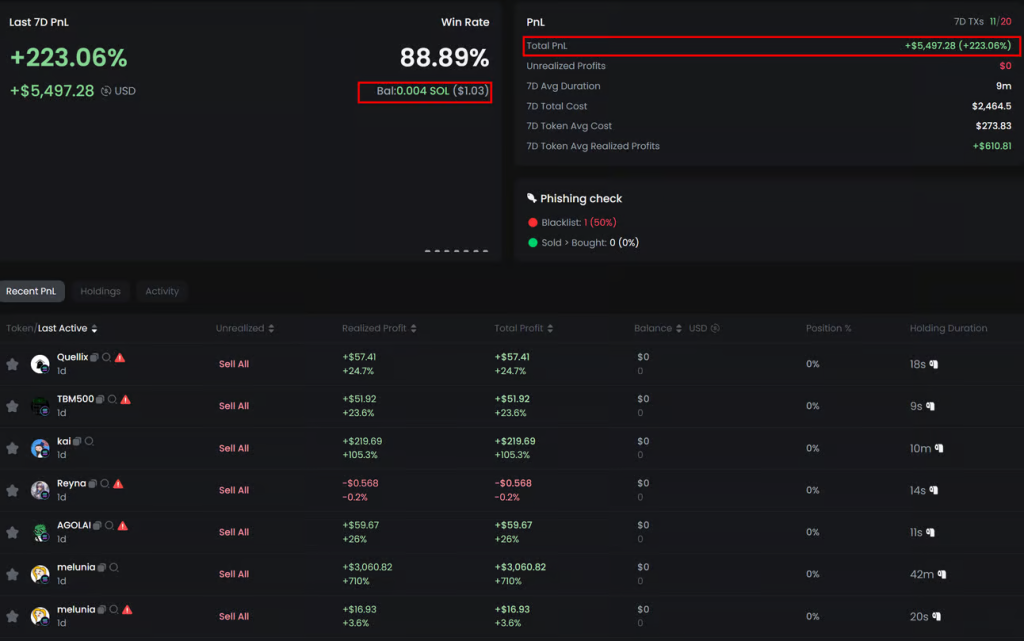

But sometimes you strike gold. This wallet made almost $5.5k in a day but has no SOL left. Let’s trace where it came from:

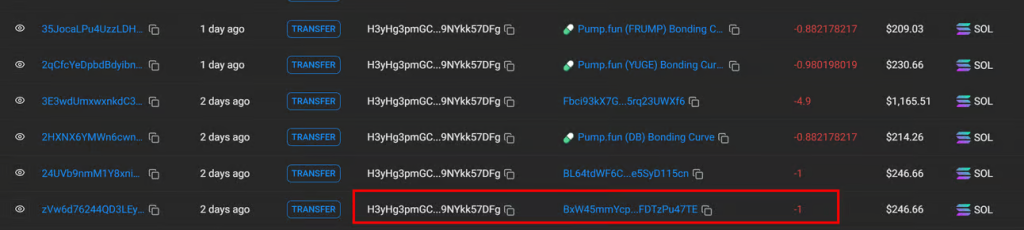

Unlike our previous example, this wallet was funded by a personal wallet with just 1 SOL. If we look at this parent wallet’s other transactions:

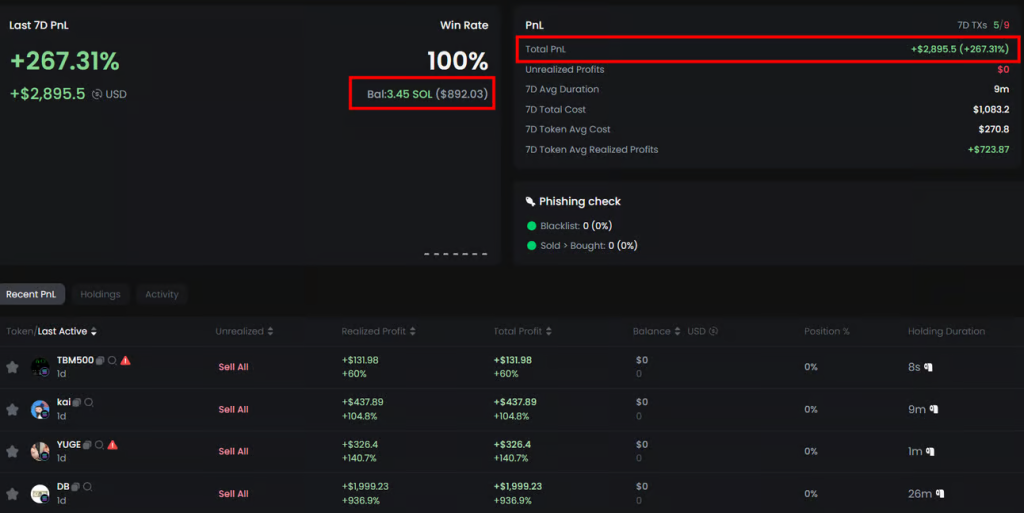

Bingo! We’ve found another wallet funded by the same parent wallet. And when we check it:

And, if we double check this wallet on Solscan, we can see that it’s indeed active and very profitable, which means it’s potentially copy-tradeable!

Final Thoughts 💭

Becoming a Solscan detective won’t happen overnight, but each investigation makes you better at spotting patterns and following smart money on Solana. If you’re a beginner, take it easy – you’ll get better with each search!

Want to level up your Solscan skills even faster? Check out my YouTube channel for detailed tutorials and join my free Telegram group where I share profitable wallets, live analysis, and copytrading strategies daily. Your next 10x might be just a Solscan search away!

Related posts:

No related posts.