Ever stared at your crypto wallet thinking, “I should be making more money than this”? Welcome to the club! Let’s face it – we all want those juicy gains, but not everyone has the time (or nerves of steel) to become a day-trading wizard. That’s where copytrading on Solana comes in – it’s like having a crypto prodigy do the heavy lifting while you kick back with your favorite beverage.

But here’s the million-dollar question: How do you pick a wallet that’ll make you money instead of burning your precious SOL to the ground?

Finding The Right Solana Wallet💘

Think of copytrading like dating. You wouldn’t marry someone after one glance at their profile pic, right? Same goes for wallets – you need to check their stats, history, and whether they’re actually active (ghosting is bad in both dating AND copytrading).

Obviously, you have to do this while avoiding the 9 most common copytrading mistakes most people make.. and then wonder why their portfolio vanished.

The Basics 📝

Before diving into any wallet’s trading history, check these two non-negotiables:

- Is the wallet profitable? (Sounds obvious, but you’d be surprised how many people skip this step)

- Does it hold SOL? (No SOL usually means an inactive wallet)

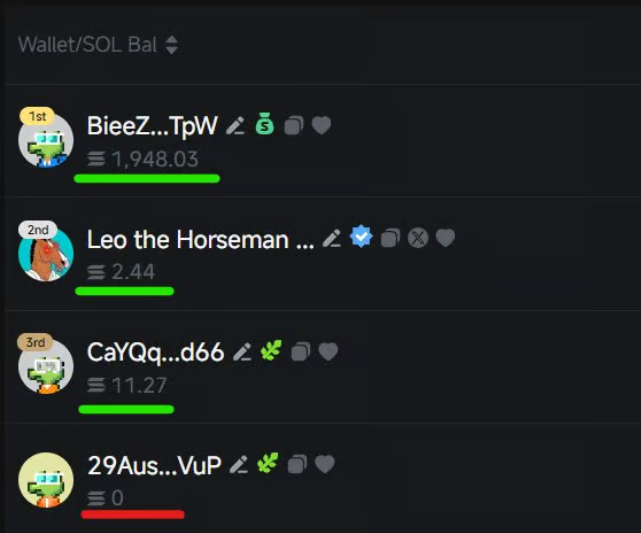

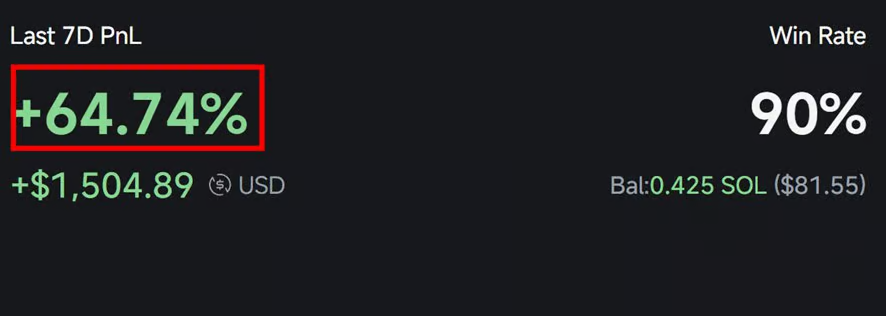

Look at this example:

From the above image you can see:

- Wallet 1: 1,948.03 SOL

- Wallet 2: 2.44 SOL

- Wallet 3: 11.27 SOL

- Wallet 4: 0 SOL (immediate swipe left!) 👈

It makes no sense to analyze a wallet with 0 Solana balance, as the chances of it trading back again are close to zero.

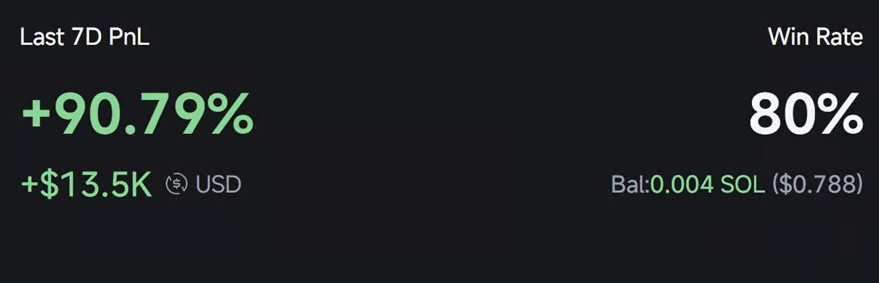

🎯Win Rate: The most over rated statistic

Win rate is the crypto equivalent of dating someone just because they’re hot. Looks good on paper but might be a disaster in real life!

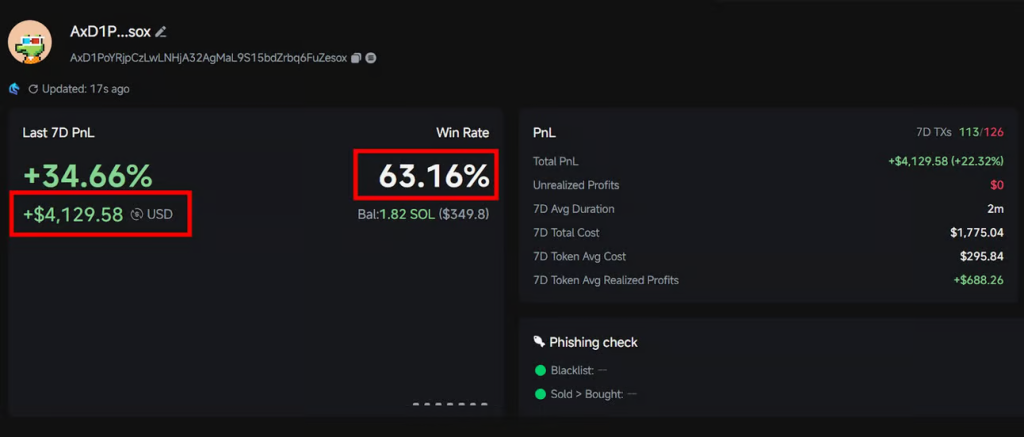

Plot twist: A wallet with a 63% win rate might actually outperform one with an 80% win rate.

Why? Because it’s not about how often you win – it’s about how BIG you win when you do, and how SMALL you lose when you don’t.

Remember this golden rule: The bottom line matters more than the percentage. A wallet/trader who makes +$500 on wins and -$50 on losses beats someone with more wins but smaller margins every single time.

Here’s why: Let’s examine our second example. This wallet has made over $4,100 in profits with a more modest 63% win rate. This is because it manages its losses effectively while capturing significant gains when opportunities arise.

Who cares about win rate when money is flowing in?

Remember: The key isn’t just about how often a wallet wins, but rather the relationship between its winning and losing trades. A wallet making substantial profits on winning trades while minimizing losses on unsuccessful ones can be more valuable than one with a higher win rate but smaller overall gains.

ROI: Show Me The Money! 💸

Return On Investment is where the rubber meets the road. It’s like checking if your date has an actual job or just “works in crypto” (we all know that guy).

Imagine ROI this way: if a wallet grows $100 to $200, it achieves a 100% ROI, meaning the investment has doubled. However, what qualifies as a “good” ROI varies based on your risk tolerance:

For the risk-averse among us:

- Look for wallets with 30-50% ROI (steady and reliable)

For the thrill-seekers:

- Target wallets showing 100-200%+ ROI (higher rollercoaster, bigger drops)

WARNING: Be suspicious of wallets with ROIs below 20-30%. Transaction fees will eat your lunch, dinner, and midnight snack at those levels!

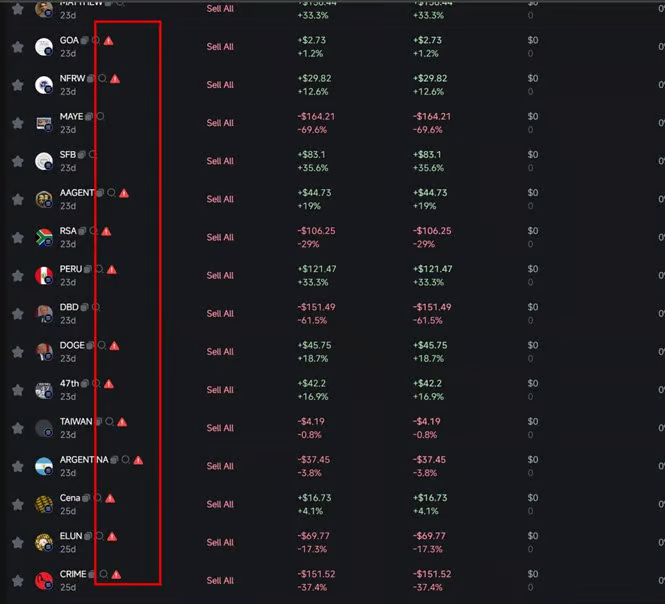

Traded Tokens Quality 🧐

You can tell a lot about someone by their friends. Similarly, you can tell EVERYTHING about a trader by the tokens they buy.

This is one of the biggest copytrading mistakes people make: They don’t care about what tokens the given wallet traded, they just look at the stats!

Red flags to watch for:

- Wallets trading way too many freshly launched tokens (less than few hours old)

- Too many traded tokens with warning signs (red triangles)

- Low liquidity to market cap ratios (under 5%)

Here’s a quick cheat sheet:

| Red Flag Wallet | Green Flag Wallet |

|---|---|

| Tokens < 24h old | Tokens > Couple days old |

| Liquidity/MCap < 5% | Liquidity/MCap > 15% |

| Volume drops 90% after spike | Stable volume for 48h |

Holding Duration ⏱️

Some wallets hold tokens for minutes; others for days or weeks. This is CRUCIAL to match with your trading style.

Short-term traders (minutes to hours):

From the picture above, we can see that these types of wallets do:

- Need constant monitoring

- Require fast copying tools (like OdinBot with 1-second response time)

- Higher stress, potentially higher rewards

Long-term traders (days to weeks):

On the other hand, the longer term holder wallets:

- More forgiving timing for copying trades

- Lower stress

- Often indicate more thorough analysis

My hot take? Unless you’re glued to your screen 24/7 or using lightning-fast bots, avoid wallets with super-short holding times. Those 6-second trades are like trying to catch falling knives while blindfolded!

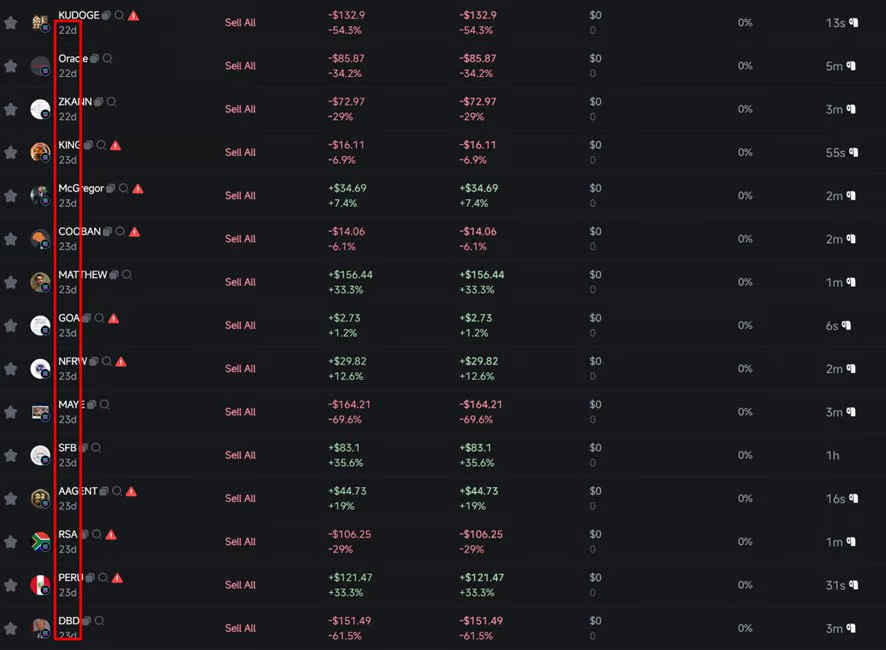

Trading Frequency: Quality Over Quantity 📊

More isn’t always better (in life and in copytrading). A wallet making 50+ trades daily isn’t necessarily outperforming one making 5 strategic moves.

Examining this example, you can see that the trades are concentrated within the same time frame (22-23 days ago). This indicates a high-frequency trading pattern, where numerous trades occur in rapid succession.

Remember: Every trade costs you fees:

- Network fees for buying

- Network fees for selling

- Bot fees for copying

If your portfolio is under 5 SOL, stick with wallets making no more than 3-5 trades daily. Your wallet will thank you!

The Ultimate Copytrading Cheatsheet 📋

When hunting for the perfect wallet to copy, look for:

- The Vitals: Profitable wallet with actual SOL holdings

- The Sweet Spot: Win rates around 60-65% (not suspiciously high)

- The Money Maker: ROI of 30-50% (conservative) or 100%+ (adventurous)

- The Quality Check: Trades established tokens (7+ days old) with healthy liquidity

- The Timing: Holds positions for hours/days rather than minutes

The Pace: Makes quality trades, not just quantity (especially for smaller portfolios)

Final Thoughts: The Wallet Whisperer's Advice 🧠

Copytrading isn’t about finding the flashiest wallet with the biggest gains (those are often on borrowed time). It’s about finding consistent performers who match YOUR trading style and risk tolerance.

Remember this: The best traders aren’t always the ones making the most noise – they’re the ones quietly stacking gains day after day while everyone else chases the next shiny object.

And above all – don’t throw your life savings into copytrading just because some dude on the internet (yes, even me) told you it was a good idea. Start small, test different wallets, and always keep some SOL in reserve for the proverbial rainy day.

Ready to find your wallet soulmate? Happy hunting! 💎🙌

Related posts:

No related posts.